Roth Ira Rules 2025

BlogRoth Ira Rules 2025. 401 (k) limit increases to $23,000 for 2025, ira limit rises to $7,000. The rules are based on the current regulations on roth deferral elections.

Our free roth ira calculator can calculate your maximum annual contribution for 2025 and estimate how much you’ll have in your roth ira at retirement. $8,000 if you’re age 50 or older.

Roth IRA Rules What You Need to Know in 2019 Roth ira rules, Roth, The annual contribution limit to both traditional and roth iras is $7,000 for 2025, which is a $500 increase from 2025. $8,000 in individual contributions if you’re 50 or.

Traditional vs. Roth IRA Yolo Federal Credit Union, This limit applies across all. Washington — the internal revenue service announced today that the.

Roth IRA Withdrawal Rules for 2025, And for 2025, the roth. The annual contribution limit to both traditional and roth iras is $7,000 for 2025, which is a $500 increase from 2025.

Roth IRA Early Withdrawals When to Withdraw + Potential Penalties, The maximum contribution limit for both types. Who is eligible to contribute to a roth ira?

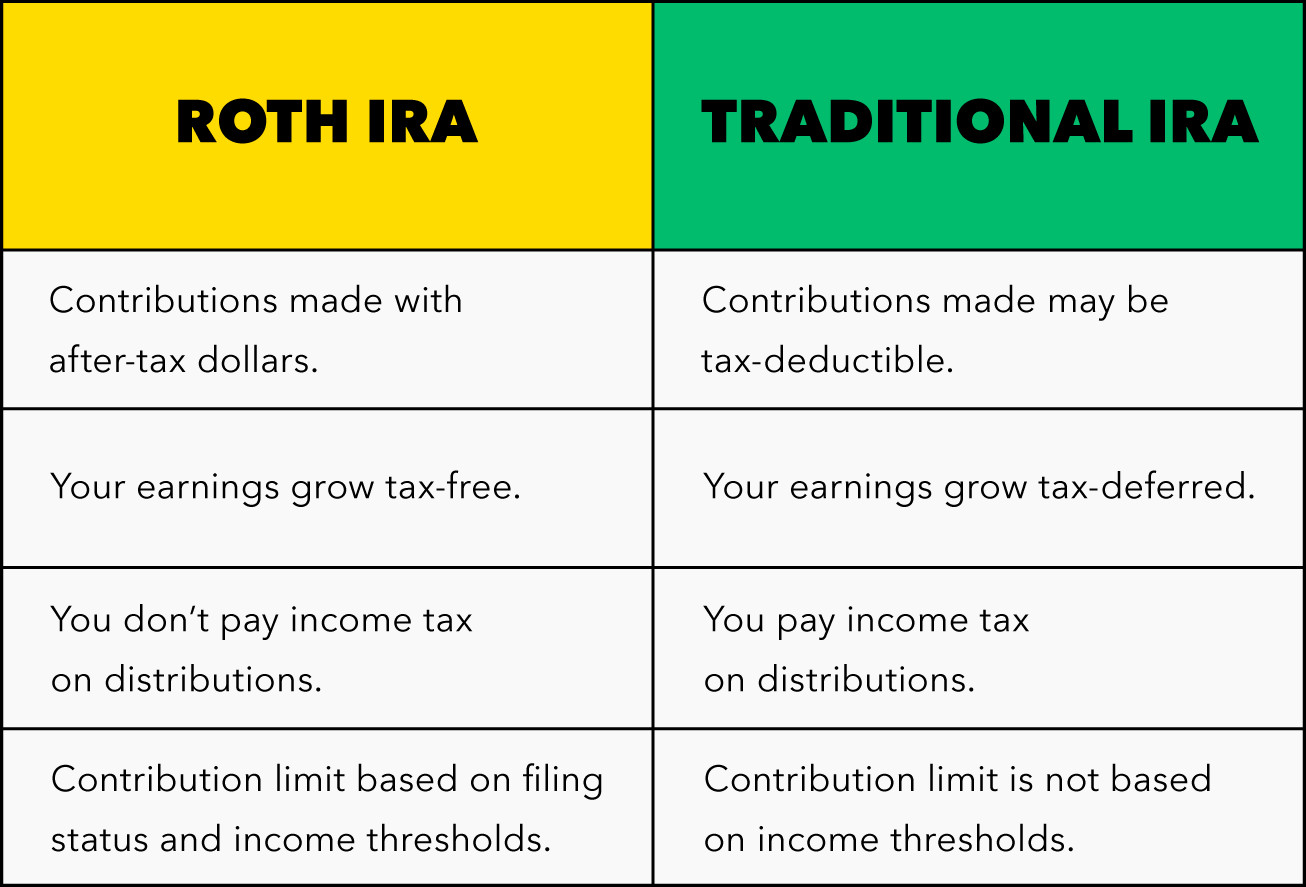

Here are the key differences between a Roth IRA and a traditional IRA, What are the rules for a roth ira? Is it right for you?

Roth IRA For Kids Make Your Grandchildren Millionaires RetireGuide, What are the roth ira rules? In a roth ira conversion, you can roll funds.

What is a Roth IRA? The Fancy Accountant, The roth ira contribution limit for 2025 is $7,000, or $8,000 if you’re 50 or older. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025.

What is a Roth IRA? The Fancy Accountant, You will generally owe income taxes on the money you convert. 1 of the year in which you did your first conversion, and — because you’re over 59½ — it won’t restart.

Does a Roth IRA Account Make Sense for You? Gorfine, Schiller & Gardyn, The roth ira contribution limits will increase in 2025. Here are the major roth ira rules at a glance.

The 5Year Rules for Roth IRA Withdrawals Pure Financial Advisors, The annual contribution limit to both traditional and roth iras is $7,000 for 2025, which is a $500 increase from 2025. And for 2025, the roth.