2025 Quarterly Estimated Tax Due Dates

Blog2025 Quarterly Estimated Tax Due Dates. Stay updated with deadlines for filings, payments, and more for timely compliance. While specific dates could vary slightly from year to year, they will always fall in the middle of january, april, june, and september, typically on.

2025 quarterly estimated tax due dates and dates karyl dolores, discover everything about irs estimated tax payments for 2025. Quarterly estimated tax dates 2025.

Your Guide to Quarterly Estimated Taxes Brightwater Accounting, Learn about advance tax, its applicability, due dates for f.y. Explore the essential dates in the income tax calendar for f.y.

HOW to Calculate Quarterly Estimated Taxes YouTube, The table below shows the payment deadlines for 2025. Final payment due in january 2025;

2025 Irs Quarterly Payments Elana Harmony, If the 15th falls on a weekend or a holiday, then the due date is the next weekday. Estimated tax payments are typically made incrementally, on quarterly tax dates:

Find Out The Penalty For Not Making Quarterly Tax Payments, If she decides to make “quarterly” tax payments instead of paying all her estimated tax by april 15, she must also make payments on june 17, 2025, sept. Stay updated with deadlines for filings, payments, and more for timely compliance.

Did you know the estimated tax payment due dates? tax TaxAdvisors , Quarterly tax due dates 2025. While specific dates could vary slightly from year to year, they will always fall in the middle of january, april, june, and september, typically on.

T200018 Baseline Distribution of and Federal Taxes, All Tax, When are estimated tax payments due? The dates do not cover all tax.

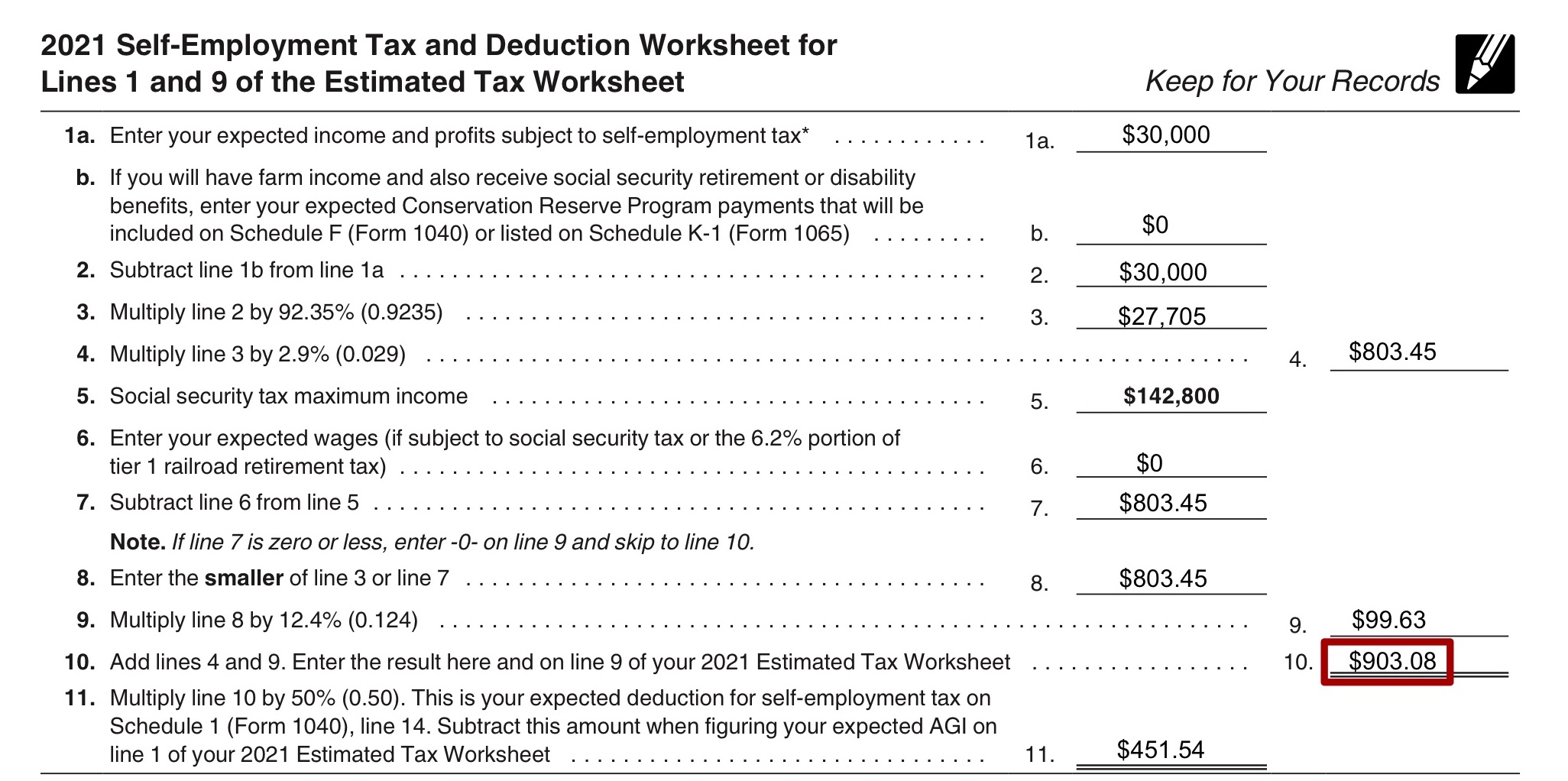

T200055 Share of Federal Taxes All Tax Units, By Expanded Cash, When are estimated tax payments due? To figure out your estimated quarterly tax estimate, use form 1040 es (estimated tax for individuals).

How do I file estimated quarterly taxes? Stride Health, Quarter 4, september 1 to december 31: The final quarterly payment is due.

quarterly tax due dates Irs Website, Quarterly Taxes, Tax Questions, The dates do not cover all tax. It’s important to note that taxpayers.

What To Do If You Miss a Quarterly Tax Payment, Payments for estimated taxes are due on four different quarterly dates throughout the year. When are estimated taxes due?